Download 300dpi JPEG image, ‘minebw.jpg’, 124K (Media are welcome to download/publish this image with related news stories.)

ALBUQUERQUE, N.M. — The solution to some of the country’s energy woes might be little more than hot air.

That’s a route researchers at Sandia National Laboratories, a Department of Energy laboratory, are helping explore in an inactive limestone mine in northeastern Ohio.

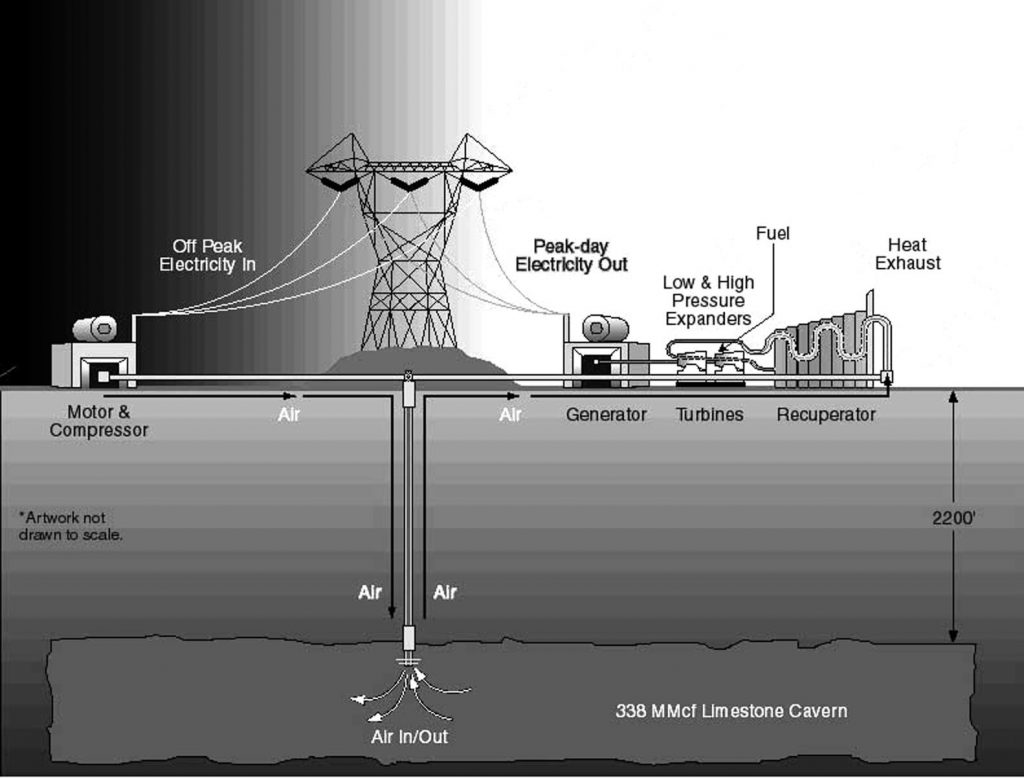

A Sandia team led by researcher Steve Bauer has been working with Houston-based Haddington Ventures and its subsidiary Norton Energy Storage LLC to determine the feasibility of using a 2,200-foot-deep inactive mine near Norton, Ohio, as the storage vessel for a compressed air energy storage power plant.

“The intent is to cycle air pressure into the mine using compressors during off-peak electrical power at times like evenings and weekends to increase air pressure in the mine,” Bauer says. “During the daily peak needs for electricity, air pressure will be bled off through modified combustion turbines to generate electricity. The energy is stored as pressure, but the mine must hold air to store the pressure.” Working pressures in the “air-tight” mine will range between about 1,600 and 800 psi.

Haddington and Norton Energy plan to have the plant on line in two years. In October 1999 Norton Energy purchased the site and the limestone mine, and in July 2000 Norton Energy signed an agreement with the City of Norton to cooperate to build the plant. Permits are currently being sought through the state’s regulatory agencies. Norton Energy will build and operate the plant. On March 20, the Ohio Power Siting Board issued a report recommending approval of authorization to build the plant.

While the concept of compressed air energy storage is more than 30 years old, only two such plants exist — a ten-year-old-facility in McIntosh, Ala., about 40 miles north of Mobile, and a 23-year-old plant in Germany, both in caverns created in salt deposits. The Norton plant will be the first in a limestone mine.

Sandia’s role has been to characterize the rock mechanics and air-flow properties of the limestone and overlying shale in response to pressure cycling. The characterization included analyses to assess the geologic, hydrologic, and rock physics data. Without clear understanding of the behavior of the rock in a pressurized state, and the behavior of fluids in the rock, regulatory and funding agencies would have been reluctant to support the project. Sandia teamed with Hydrodynamics, a consulting group, in completing the characterization.

Bauer and other Sandia team members spent six months — November 1999 through April 2000 — in Norton studying the mine’s geology.

The Sandia team found that the mine consisted of a very dense rock with low permeability. It was stiff and strong and had few, if any, natural fractures.

“This all led to the conclusion that the mine would likely hold air at the required storage pressures and would work well as an air storage vessel for a compressed air energy storage power plant,” Bauer says.

Download 150dpi JPEG image, ‘Bauer.jpg’, 96K (Media are welcome to download/publish this image with related news stories.)

The Pittsburgh Plate Glass Company operated the mine between 1943 and 1976, producing synthetic soda ash used in manufacturing glass. The 643-acre mine is built in a room and pillar configuration with 338 million cubic feet of space. Despite being well below the water table, the mine is virtually dry.

The power plant will be built in units brought on line in increments of 300 megawatts as units are completed. Ultimately up to about 2,700 megawatts will be built, which will be enough generating capacity for about one million homes.

The power from the plant will not be sold directly to consumers. It will generate wholesale electric power for sale to utilities and marketing companies for use during peak energy usage times.

In addition to providing more power during peak times — and possibly helping Ohio and the surrounding region avert blackouts and brownouts — the compressed air energy storage power plant has the advantage of being environmentally friendly.

“During electric generation, some natural gas will be burned to super-expand the compressed air,” Bauer says. “When at its full production stage of 2,700 megawatts, it will produce the same amount of emissions as a 600-megawatt gas-powered combustion turbine power plant.”

Haddington Ventures was formed in 1997 to invest in opportunities in the U.S. energy industry that result from deregulation, convergence of gas and electricity, consolidation and introduction of new technologies. It is affiliated with J.P. Morgan Partners, a global private equity organization.

Technical contact:

Steve Bauer, sjbauer@sandia.gov, (505) 844-9116